The company works with governments, intergovernmental organisations, and Fortune 500 corporates to build trusted systems that enable transparency and compliance across carbon trading, ESG data, and sustainable supply chains.

With flagship projects spanning Asia, Africa, and Europe — including partnerships with Fortune 500 companies and multiple government agencies — Xeptagon’s platforms support both voluntary and compliance carbon markets, helping institutions meet the Paris Agreement’s Article 6 requirements and new trade-linked regulations such as the EU Carbon Border Adjustment Mechanism (CBAM).

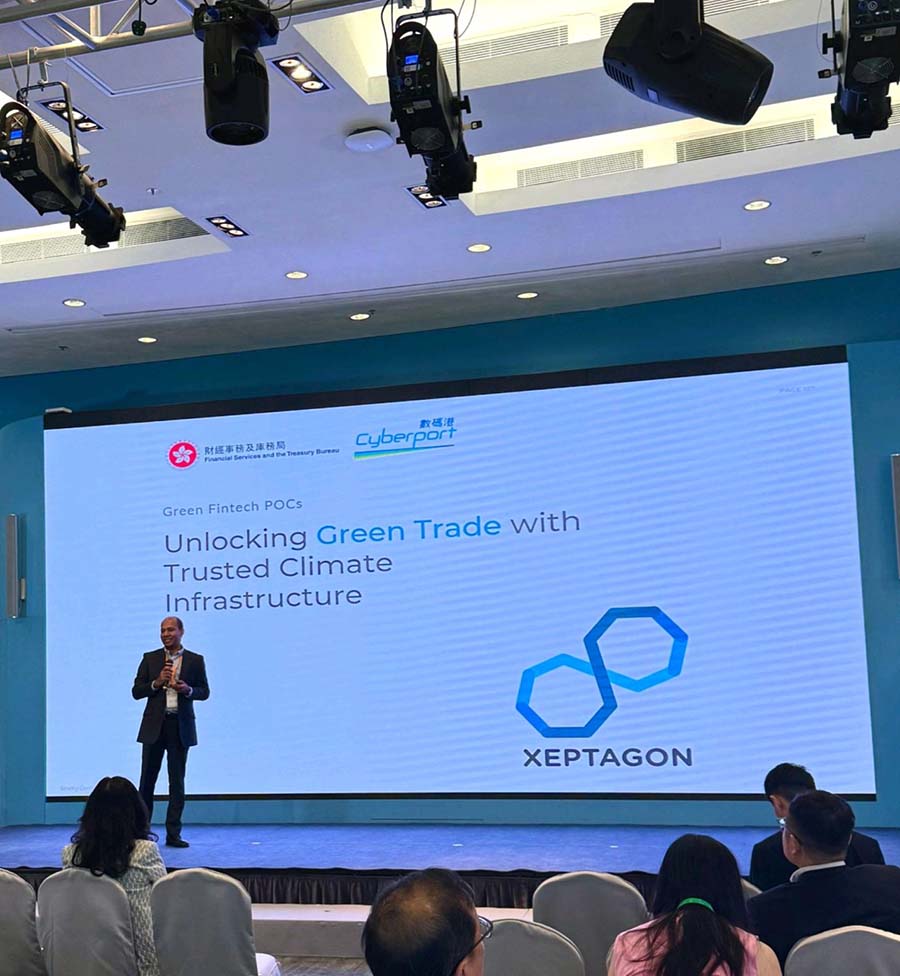

Green FinTech POCs Supporting a Carbon-Neutral Future

Xeptagon recently delivered three Green FinTech Proof-of-Concepts (POCs) under Hong Kong’s Green and Sustainable FinTech Proof-of-Concept Funding Support Scheme, sponsored by the Financial Services and the Treasury Bureau (FSTB) and administered by Cyberport Hong Kong.

Developed in collaboration with Schneider Electric, Tessellation Group, and THINK ESG Ltd., the projects demonstrate how financial innovation and technology can enable measurable, verifiable progress toward carbon neutrality.

The three POCs — focused on Green Credit Management, Carbon Trading, and Supply Chain Transparency — provide practical solutions for banks, regulators, and corporates preparing for CBAM compliance.

Together, they showcase Xeptagon’s approach to integrating verified emissions data, blockchain-based registries, and smart analytics into climate finance infrastructure.

“Our goal is to make sustainable finance practical and verifiable,” said Dr. Sapumal Ahangama, Co-Founder and CEO of Xeptagon.

“These collaborations show how data and finance can work together to build the trusted infrastructure needed for a carbon-neutral economy.”

Global Recognition and Strategic Collaborations

Xeptagon’s growing influence in climate-fintech has been recognised globally.

The company was selected for the Accenture FinTech Innovation Lab Asia-Pacific 2025, joining a selective cohort of fewer than 400 startups globally mentored over the last decade by leading institutions such as Global Banks, Accenture, and Cyberport Hong Kong. Alumni of this programme have collectively raised more than US $6.6 billion worldwide.

Xeptagon was also named a finalist in the Hong Kong Green FinTech Competition 2025, hosted by the Hong Kong Monetary Authority (HKMA), and is featured on the Hong Kong Green FinTech Map 2025 among the region’s top climate-finance innovators.

In addition, the company was recognised as a Top-10 global finalist in the Digital Public Infrastructure (DPI) Innovation Challenge, organised by the Japan International Cooperation Agency (JICA) and the Boston Consulting Group (BCG), for developing an open-source registry module that integrates SDG co-benefits into carbon accounting systems.

A Global Footprint Rooted in Two Innovation Hubs

Xeptagon operates from two key innovation centres: Port City Colombo, where it opened the first operational office in the Port City IT Park last month, and Cyberport Hong Kong, Asia’s premier technology hub that hosts multiple unicorns.

These twin hubs connect South Asia’s emerging climate-tech ecosystem with Asia-Pacific’s fintech leadership, enabling Xeptagon to bridge innovation, finance, and policy in building the digital foundation for a sustainable future.

“We believe transparency is the currency of the new green economy,” added Dr. Ahangama.

“Our work connects data, finance, and policy to enable real progress toward a carbon-neutral world.”