Most countries declared prolonged lockdowns and movement restrictions with a view to controlling the disease, which severely hampered worldwide economic activity and global trade from March 2020.

Domestically, the COVID – 19 outbreak weakened the country outlook substantially as it brought further stress to an already challenged macroeconomic situation.

Responding to these economic challenges, the Central Bank of Sri Lanka took steps to cut policy rates twice during the second quarter, resulting in the Standard Deposit Facility Rates and the Standard Lending Facility Rates dropping to 5.5% and 6.5%, respectively by 30th June 2020.

At the same time, the Statutory Reserve Requirement (SRR) was reduced in two stages from 5% to 2% during 1H 2020, in a bid to improve liquidity levels in the market.

While the economy and the banking sector as a whole continued to face unprecedented challenges due to the COVID-19 pandemic, Sampath Bank is pleased to announce that its total assets crossed the Rs One Trillion (1 Tn) mark for the first time in its history.

Reaching this milestone in the span of just 33 years, probably makes Sampath Bank the youngest business organisation in Sri Lanka to achieve this significant milestone.

During this difficult period the Bank redoubled efforts to serve its valued customers, who were severely impacted by the prolonged lockdown, to overcome the challenges and hardships faced by them.

By leveraging its IT supremacy, substantial investments made in technology platforms and its widespread branch network, Sampath Bank was able to operate seamlessly during this time of disruption.

The Bank was quick to implement all the relief measures introduced by the government, with approximately 50% of the Bank's loan portfolio being granted relief under the government announced moratorium scheme.

Further, the Bank actively engaged in providing working capital loans under the ‘Saubhagya’ scheme introduced by the government and took proactive steps to provide necessary assistance to customers across all segments who required special attention, including re-scheduling of loan repayments of those customers who were severely impacted.

Given the unprecedented challenges witnessed in the first half of 2020, it is important to note that comparing the Financial result of the first half of 2020 with 2019 may not be realistic.

Financial Results of Sampath Bank for the First Half of 2020

Sampath Bank registered a profit before tax (PBT) of Rs 5.32 Bn and a profit after tax (PAT) of Rs 3.97 Bn for the six months ended 30th June 2020.

Despite the unique challenges that prevailed since mid-March 2020, the Bank was able to limit the decline in PBT and PAT to 8% and 3.2% respectively compared to the corresponding period in 2019.

The Bank made solid progress towards its targets set for 2020, which together with diversified product portfolio embedded with technological advancements and strong cost control measures helped the Bank to control the impact on profits.

PBT and PAT of the Group also declined by 7.7% and 4.2% respectively for the six months ended 30th June 2020 and stood at Rs 5.48 Bn and Rs 3.99 Bn respectively.

Meanwhile, the Bank remained well-capitalized with a Tier 1 capital ratio of 13.30% and a total capital ratio of 16.77%.

Fund Based Income (FBI)

The Bank’s Net Interest Income (NII) for the quarter ended 30th June 2020 was significantly affected by two factors - the reduction in policy rates in order to provide relief to the economy and the moratorium granted to customers.

Consequently, the day one loss on account of the COVID - 19 moratorium was recorded against the interest income as per the modification method given in the Sri Lanka Accounting Standard – 9 (SLFRS – 9).

As the entire day one loss that arose due to the COVID - 19 moratorium has been recorded during the period under review, Sampath Bank does not have to incur any additional impact on interest income during the 2H of 2020.

Due to the reasons mentioned above, the Bank's Net Interest Income declined by 11.9% and stood at Rs 17.4 Bn for the 1st half of 2020 compared to the same period in 2019.

While closely monitoring the factors affecting this reporting line, the Bank's ALCO continued to take necessary action to manage the net interest income to the best possible level.

Overall, interest income for the period decreased by Rs 5.0 Bn to Rs 46.2 Bn compared to Rs 51.2 Bn recorded in the corresponding period in 2019, denoting a decline of 9.8%.

The total interest expenses stood at Rs 28.8 Bn in 1H 2020 compared to Rs 31.4 Bn recorded in the corresponding period of 2019, a reduction of 8.5%.

Consequently, the Net Interest Margin for 1H 2020 decreased to 3.57% compared to 4.46% reported in 2019.

Non-Fund Based Income (NFBI)

Net fee and commission income, which comprises credit, trade, card, and electronic channel related fees, was limited to Rs 3.8 Bn during the period under review, a decline of 18.9% over the figure reported in 1H 2019.

The decline was mainly due to the decrease in credit-related fee and commission income consequent to the restrictions imposed to assist customers during this difficult period.

Meanwhile, the fee and commission income from electronic channels showed strong growth owing to the high usage of Sampath Vishwa and other popular electronic products.

Other operating income (net) recorded a significant YoY increase of 509% in the 1st half of 2020, led mainly by an increase in realized exchange income due to the 2.7% depreciation of the Sri Lankan Rupee against the US Dollar. Consequently, other operating income (net) for the first six months of 2020 increased to Rs 2.6 Bn, from the loss of Rs 642 Mn reported for the corresponding period in 2019.

On the other hand, the Bank incurred a net trading loss of Rs 107 Mn as a result of mark to the market losses on forward exchange contracts owing to the aforementioned currency depreciation.

Therefore, the Bank's net exchange income from foreign exchange transactions amounted to Rs 1.8 Bn for the period under review.

Operating Expenses

Operating expenses, which stood at Rs 10.1 Bn during 1H 2019, decreased to Rs 9.6 Bn during the period under review, reflecting a YoY decline of 5.2%.

The cost optimization strategies implemented by the Bank to face the situation was instrumental in this achievement.

Meanwhile, the Bank’s Cost-to-Income ratio (excluding taxes on financial services) increased marginally to 40.2% in the first six months of 2020, from 38.8% reported for the corresponding period in 2019.

The main reason for this marginal increase was the drop in the key income sources during the first half of 2020.

Impairment Charges on Loans and Receivables

The Bank has provided a substantial credit loss provision for customers whose credit risk has significantly increased due to the prevailing economic recession.

As a result, the impairment charge against individually significant customers increased to Rs 4.3 Bn in 1H 2020 from Rs 2.5 Bn in the corresponding period in 2019.

After analyzing the economic downturn, Sampath Bank’s management decided to increase the credit loss provision at the portfolio level as well.

However, the collective impairment charge for the first six months of 2020 is lower compared to the first half of the last year due to the explanation given below.

The credit quality of the loan portfolio was severely affected in April 2019 due to the terrorist attack that took place in April 2019 which prompted the Bank to increase its collective impairment provision in Q2 2019.

Business Growth

Sampath Bank’s total asset base grew by 4.5% (annualized 9.0%) during the period under review to reach Rs 1 Tn as at 30th June 2020. It stood at Rs 962 Bn as at 31st December 2019.

Gross loans & advances grew by 3.9% (annualized 7.8%) to reach Rs 748 Bn as at 30th June 2020, recording a growth of Rs 28 Bn for the period under review.

The total deposit base increased by Rs 72 Bn for the same period, to reach Rs 790 Bn as at the reporting date, a growth of 10% (annualized 20%).

Meanwhile, the CASA ratio, which stood at 36.6% as at 30th June 2020 improved marginally from the 31st December 2019 position of 35.2%.

Performance Ratios

Return on Average Equity (ROE) (after tax) declined from 11.78% as at 31st December 2019 to 7.56% as at 30th June 2020, in direct correlation to the lower PAT.

Return on Average Assets (ROA) (before tax) also declined to 1.09% from 1.66% as at 31st December 2019.

The Statutory Liquid Asset Ratio (SLAR) for the Domestic Banking Unit and the Off-Shore Banking Unit stood well above the mandatory requirement of 20% throughout the period and ended up at 28.12% and 33.88% respectively as at 30th June 2020.

Capital Adequacy

The Bank’s Common Equity Tier I Capital, Tier I Capital and Total Capital Adequacy ratios as at 30th June 2020 stood at 13.30%, 13.30% and 16.77% respectively, all well above the minimum regulatory requirement of 6.5%, 8% and 12.0%, applicable as at the reporting date.

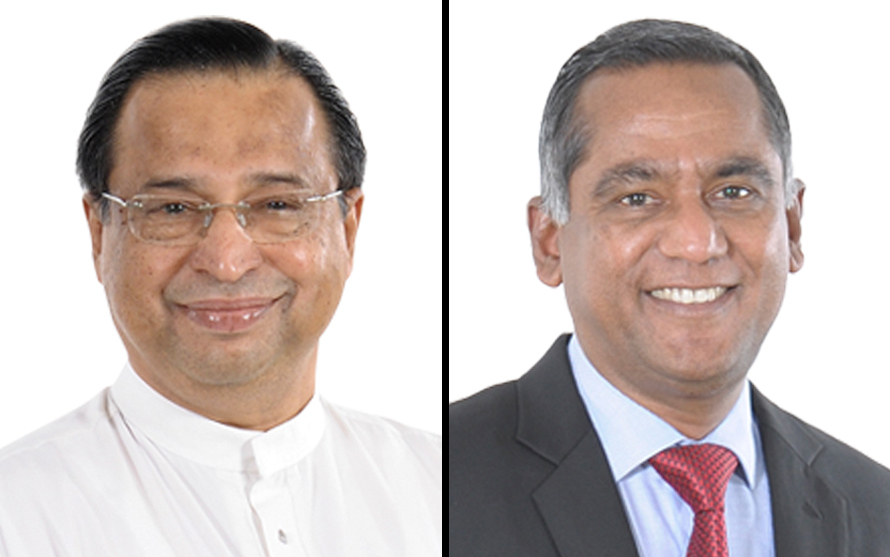

Photo - Left to Right : Prof Malik Ranasinghe, Chairman, Sampath Bank PLC & Nanda Fernando, Managing Director, Sampath Bank PLC.