CFA Society Sri Lanka is part of the worldwide network of CFA Institute member societies that lead the investment profession globally by promoting the highest standards of ethics, education, and professional excellence.

There are more than 190,000 CFA® charterholders worldwide in more than 164 markets.

CFA Institute has nine offices worldwide and there are 160 local societies.

Considering the need of the hour to improve financial literacy among Sri Lankans, CFA Society Sri Lanka has forged a partnership with CSE to increase the level of financial literacy through many initiatives, including the bell-ringing ceremony, and the book launch.

The ceremony was attended by Mrs. K.M.A.N. Daulagala, Deputy Governor of the Central Bank of Sri Lanka (CBSL), Mr. Chinthaka Mendis, Director General, Securities and Exchange Commission of Sri Lanka (SEC), Mr. Aruna Perera, CFA, Vice President, CFA Society Sri Lanka, Mr. Ravi Abeysuriya, CFA, Author of the Financial Literacy book and Director of CFA Society Sri Lanka, Mr. Aruna Alwis, CEO of CFA Society Sri Lanka, Mr. Victor Navaranjan Antonypillai, Acting Country Manager, International Finance Corporation (IFC) Sri Lanka and Maldives, Ms. Thusitha Molligoda, Senior Investment Officer, Asian Development Bank, Mr. Murtaza Esufally, Chairman, Hemas Holdings PLC, Mr. Kapila Ariyaratne, CEO, Seylan Bank PLC, Mr. Dilshan Rodrigo, COO, Hatton National Bank PLC, Mr. Dilshan Wirasekara, Chairman, CSE, Mr. Rajeeva Bandaranaike, CEO, CSE and individuals from state and non-state universities, the senior management of the CSE and members from CFA Society Sri Lanka.

Welcoming the invitees to the ceremony, CSE Chairman Mr. Dilshan Wirasekera said,

“Though Sri Lanka has a long tradition of having a high literacy rate of over 92%, financial literacy is lower at 58%, an issue that needs to be addressed carefully.”

“The country’s investments should be channeled to the sectors of the economy which really need it.

Investors need to be aware of the products and services that capital markets and financial markets offer.

And CSE is very proud to champion this initiative along with the SEC, IFC, CBSL, CFA Society Sri Lanka to further discourse.

As part of the CSE’s role, we have been active in conducting Investor Forums Island wide.

We already conducted two Forums in Kandy and Galle this year,” he added.

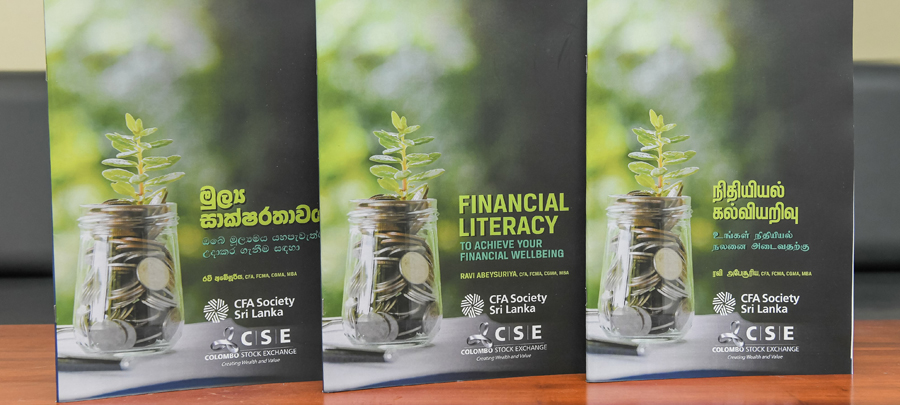

CFA Society Sri Lanka Vice President, Mr. Aruna Perera, appreciated the initiative taken by Mr. Abeysuriya to launch the financial literacy publication in all three languages, written in simple language that everyone could understand, defined financial literacy as a body of knowledge which involves economics, business mathematics, logical skills, and the ability to apply those skills in a setting which requires an individual to make finance related decisions.

Mr. Perera also emphasized the fact that personal financial management is important for everyone as an individual, a family, a corporate, society, etc.

“Key issue that we face when making financial decisions is greed: greed to make money quickly using short-term methods.

If you are financially literate, you may think of not just short-term returns but also long-term returns.

You may also look at the risks involved in that investment,” added Mr. Perera.

Furthermore, while congratulating Mr. Ravi Abeysuriya for coming up with the publication on a topical subject, Mrs. K.M.A.N. Daulagala, CBSL Deputy Governor, presented the projects carried out by the CBSL over a long period of time to create awareness on financial education.

According to Mrs. Daulagala, in March 2021, the CBSL launched the first ever National Financial Inclusion Strategy (NFIS), and in 2018, a Financial Inclusion Survey was conducted.

She added, “The survey defined financial literacy as a combination of financial knowledge, financial attitudes, and financial behavior necessary to make informed financial decisions.

The results of the survey revealed that financial literacy is a key impediment to financial inclusion in Sri Lanka.

Therefore, financial literacy and capacity building was identified as one of the four key pillars of NFIS.”

Further revealing the key findings of the survey, she stated that almost 58 % are financially literate in Sri Lanka and which is an improvement from 35% in 2014.

“The survey assessed the level of understanding in four key concepts, and risk diversification is the least familiar among the participants.”

“Financial literacy also varies based on the different segments of the population.

Males accounted for 61%, whereas females accounted for 55 %.

It was also revealed that financial literacy among urban residents is higher than of rural residents.

Considering the age level, people above 60 showed a significantly low rate in financial knowledge and financial behavior, whereas young adults in Sri Lanka showed a higher rate in financial literacy and this could be considered as a positive aspect.”

She also mentioned that more than half of the Sri Lankans showed a positive attitude towards the safety and efficiency of digital payment methods.

So, in view of the above findings, there is a target policy intervention on financial education, awareness creation and capacity building to appropriate segments of the population and also to facilitate digital financial literacy.

Also addressing the gathering Mr. Chinthaka Mendis, Director General, SEC, noted SEC’s Capital Market Education Division has taken many steps in improving financial education among Sri Lankans.

“From next year onwards, capital market content will be a part of the school curriculum beginning from grade 6.

It has been included in the Entrepreneurship and Financial Literacy subjects, which could be considered a major step forward when educating our future generations.”

Mr. Mendis emphasized that relatively low financial literacy in the country has adversely impacted the economy.

Thus, it is necessary to put more effort in improving financial literacy in the country.

Mr. Mendis also revealed that, as a step forward to introduce new products to the market, they would allow local companies to raise capital funds in foreign currencies.

The Financial Literacy Publication, which was launched at the bell-ringing ceremony, includes all aspects of financial management, including ways to achieve financial independence & wealth, personal financial planning, how to borrow smart, managing finances, investing, wealth management and how to plan for retirement.

Commenting on the publication, the author Mr. Abeysuriya, CFA highlighted the fact that being financially literate clearly benefits individuals, households, corporates, and the country since better-informed decisions will be made by everyone.

Prioritize the needs more efficiently, increase capital productivity and borrow money with a clear understanding that the borrowed funds must generate enough income to pay the interest and repay the borrowed money even under a stressed scenario.

He also made a request to all the companies to improve financial literacy of the adult populations in Sri Lanka as a part of their CSR projects.

Image Caption

1. From L-R CSE CEO Mr. Rajeeva Bandaranaike, SEC Director General Mr. Chinthaka Mendis, CSE Chairman Mr. Dilshan Wirasekera, CBSL Deputy Governor Mrs. K M A Daulagala, Author of Financial Literacy Publication and CFA Society SL Director, Mr. Ravi Abeysuriya, CFA, CFA Society SL VP, Mr. Aruna Perera, CFA, CFA Society SL Director, Mr. Rasanja Perera, CFA and CFA Society SL CEO, Mr. Aruna Alwis.

2. Financial Literacy Publication in all three languages.