Having commenced operations in 2014, the firm has focused on delivering structured finance solutions that address the funding requirements of financial institutions across both short and long-term horizons.

The cumulative volume between 2020 and 2025 reflects growing investor appetite, trust for well-structured credit products and an evolving sophistication in Sri Lanka’s debt capital markets.

A key highlight of M Power Capital’s journey is zero default due to focussed and intelligent due diligence/risk management.

This is underscored by meticulous periodic portfolio reviews and performance monitoring with results independently audited by external accounting firms.

Additionally, select transactions are subjected to third-party ratings, further validating the risk management rigor that underpins MSEC’s structuring approach.

Over the 5-year period, the company has built a client base of more than 500, with over 50% comprising HNIs across the investor spectrum.

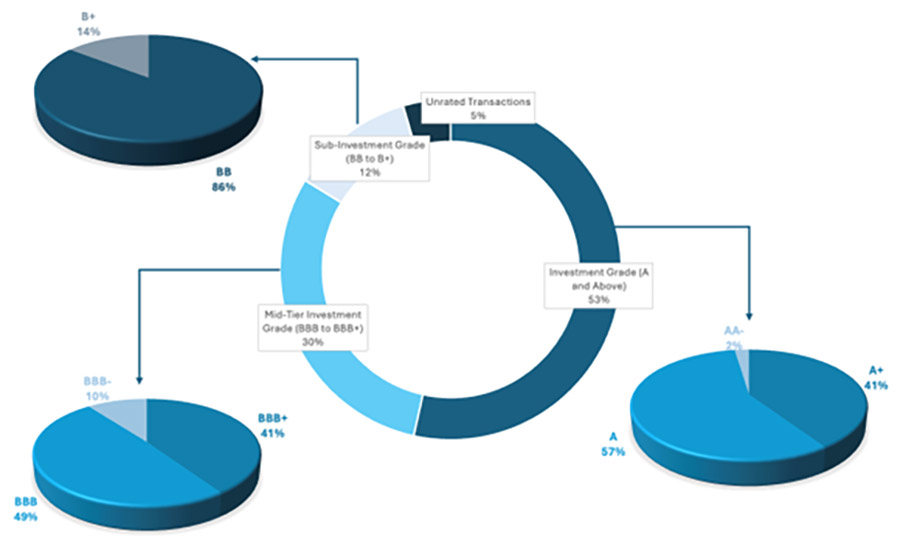

Rating-Wise Distribution of Structured Finance Transactions Volume

The transactions span a broad credit spectrum.

The majority of the transactions fall within the investment-grade category, with a balanced distribution across other risk tiers.

Unrated structures were supported by comprehensive internal credit assessments and credit enhancements where appropriate.

Unrated Issuer structures were supported by comprehensive internal credit assessments and credit enhancements where appropriate.

Contributing to Capital Market Depth

Over the five-year period, MSEC has successfully structured and placed more than 60 securitisation transactions, enabling a diverse mix of non-bank financial institutions and corporates to access funding for a variety of needs, including but not limited to short-term liquidity and longer-term capital requirements.

These transactions have contributed significantly to credit intermediation, liquidity management, and financial inclusion.

The firm’s role extends beyond advisory, encompassing transaction structuring, credit evaluation, documentation and placement, ensuring alignment of risk and return for both originators and investors.

Reaching this Rs. 53 billion milestone underscores M Power Capital’s disciplined approach, marked by transparency, robust structuring standards, and investor-centric solutions, which continues to set benchmarks for the industry.

Looking ahead, the firm remains committed to deepening partnerships with financial institutions and corporates across the country, helping them unlock new funding channels, diversify capital structures, and drive sustainable economic growth while building a more resilient and inclusive capital market ecosystem.