The forum, directed towards the nation’s foremost institutional fund managers, was a high-level platform for the collaboration in exploring and capitalizing on opportunities that the Sri Lankan capital market offers.

The forum serves to underscore the steadfast commitment of SEC and CSE to facilitate the long-term creation of value and to bolster institutional engagement in rising capital market growth.

The proceedings were marked by the presence of several senior experts from the public and financial sectors, including Hon. Prof. Anil J. Fernando, Minister of Labour and Deputy Minister of Economic Development; Dr. P. Nandalal Weerasinghe, Governor of the Central Bank of Sri Lanka; Senior Prof. D.B.P.H. Dissabandara, Chairman of the SEC; Mr. Dimuthu Abeyesekera, Chairman of the CSE; Mr. Rajeeva Bandaranaike, CEO of CSE; and Dr. Naveen Gunawardane, Co-Founder and Managing Director of Lynear Wealth Management.

A high-level panel discussion formed the principal component of the programme moderated by Mr. Shiran Fernando, Chief Economic Policy Advisor of the Ceylon Chamber of Commerce.

The panel discussed the future of allocations into equity amidst the ongoing financial climate, the role of digital democracy in maintaining the government’s policies of good governance, the SEC’s new strategic plan “12 Pillars One Vision for a Resilient Market” as well as questions from the investment fund managers, such as the role of the EPF and ETF moving forward.

The robust exchange afforded fund managers the opportunity to examine long-term investment paradigms and the growth of the capital market.

The Hon. Prof. Anil J. Fernando, Minister of Labour and Deputy Minister of Economic Development, in his keynote address, articulated the government’s perspective on the favourable investment culture that has arisen in the country through the stabilization of inflation at 5%, assuring the forum that “Our Government’s key role is that of a facilitator rather than being a part of the politicization.

Giving the freedom and autonomy for all these agencies to come out with your expertise and competencies.”

To that end, the Minister stated that the government’s pre-existing guidelines on the capital market aimed at creating a level playing field, enforce rule of law, and bring new enactments to enhance investor confidence.

During the panel discussion Central Bank Governor, Dr. P. Nandalal Weerasinghe, touching on Dr. Gunawardane’s presentation, spoke of how the ongoing commitment to fiscal discipline has and will continue to produce a sustained positive current account balance.

He added, “We have generated domestic savings which is more than enough for investment needs in the country.

This is a new situation.” He compared the current macro-economic environment to past decades, which were marked by current account deficits and constrained domestic savings.

Furthermore, the Governor stated that stable inflation in a low interest environment would encourage investors seeking returns to look beyond just the banking sector.

Asked at the panel discussion about the SEC’s landmark strategic plan titled "12 Pillars One Vision for a Resilient Market" Senior Prof. D.B.P.H Dissabandara, Chairman of the SEC, reiterated its applicability to institutional investment funds – specifically the consolidation of funds, both domestic and international.

He noted the SEC’s dual role as both regulator and facilitator and cited the SEC’s success in creating a level playing field and ensuring transparency in the capital markets.

Lauding the Central Bank, he noted that the state of the economy has transitioned from “the state of rescue to recovery.

The next phase is growth – and you cannot grow without capital.

Thus, we must consider the investment avenues and consider which segments of the economy we wish to prioritize, which requires centralized decision-making.”

Mr. Dimuthu Abeyesekera, Chairman of CSE, noted the underrepresentation of the population in the capital market was a barrier to growth, with Sri Lanka’s 50,000 active investors amounting to only 0.2% of the total population.

He explained that outreach beyond the Western Province is necessary, as account openings outside the province currently represent only 39% of the total openings.

CSE has already established ten branches outside Colombo, with branches in all nine provinces and aims to create twenty-five branches – a branch per district.

By the year end, the CSE will open four more branches in Kegalle, Galle, Maharagama and Gampaha.

Such outreach targets potential investors who have traditionally relied on the banking sector for returns and, due to low interest rates, may seek alternative investment avenues.

These investors, Mr. Abeyesekera noted, are vulnerable without a trusted market facilitator.

“We, the CSE, must fill that gap. We are regulated by the SEC and are a legalized entity.

Outside the Western Province, there are no investment opportunities apart from the banking sector.”

Mr. Rajeeva Bandaranaike, CEO of CSE, contextualized the forum’s role, outlined the history of share trading in Sri Lanka, and highlighted the role the CSE plays as it commemorates its 40th anniversary.

Acknowledging the noteworthy progress made over the years, he also highlighted the challenges of the future – namely, expanding the breadth and depth of the market.

He emphasized the efforts to address these challenges, ranging from financial literacy drives, improving market infrastructure, and creation of new capital instruments.

Noting the dominance of both domestic institutional and retail investors, he observed that the low interest regime has renewed investor interest in the capital market.

Addressing the audience, he said “Institutional Funds play a catalytic role in the overall development and broadening of the market by providing professional portfolio management services with due diligence, integrity and financial acumen required, while also contributing to liquidity and activity in the secondary market.”

Finally, in his presentation, which primed the panel discussion, Dr. Naveen Gunawardane, Co-Founder and Managing Director of Lynear Wealth Management, spoke on the paradigm shift in equities.

In his in-depth analysis he explored how the transformed macro-economic environment, resulting from the government’s financial discipline, would compel institutional funds to reconsider sole reliance on the debt market if they wished to achieve their target returns.

Dr. Gunawardane noted “If the country can run a primary surplus which in turn can lead to more stable interest rates, then it is going to force all of us to reconsider our asset allocation.

The fundamental question we, as institutional investors, must ask ourselves is; can you meet your target return through fixed income alone?

In this new macro-economic environment, you may find that you cannot.”

Dr. Gunawardane noted at the forum that institutional investors with pre-existing equity investments should consider increasing their allocations while those without should seriously consider initiating them if the underlying assumption was that the government would continue with the Central Bank Act and the Public Finance Management Act beyond the end of the IMF program.

The forum is part of a broader initiative to engage the wider investor market in the healthy growth currently underway in the capital market, and to empower institutional investors to exercise judicious allocation decisions that support both growth and portfolio diversification.

Both the SEC and CSE are committed to sustaining this effort through continuous engagement and the convening of similar strategic forums across the country.

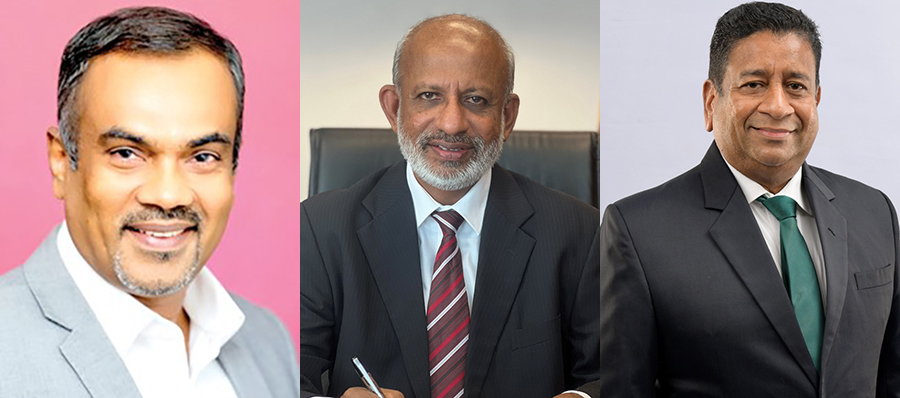

Caption left to right - Hon. Prof. Anil J. Fernando, Minister of Labour and Deputy Minister of Economic Development, Senior Prof. D.B.P.H. Dissabandara, Chairman of the SEC and Mr. Dimuthu Abeyesekera, Chairman of CSE

Caption left to right - Mr. Rajeeva Bandaranaike, CEO of CSE and Dr. P. Nandalal Weerasinghe, Governor of the Central Bank of Sri Lanka

Caption left to right - Dr. Naveen Gunawardane, Co-Founder and Managing Director, Lynear Wealth Management and Mr. Shiran Fernando, Chief Economic Policy Advisor, Ceylon Chamber of Commerce

Caption - Institutional Fund Managers during the Q&A segment of the panel discussion