The January 2020 performance was 1.03% (annualised 12.18%).

Ceylon Asset Management competes with international USD bond managers in operating the Ceylon Dollar Bond Fund (CDBF), Sri Lanka’s first international sovereign bond fund that navigates global market conditions.

The SL ISB rates were influenced last year by two US Federal Reserve rate cuts, the Easter bombing and a Presidential election.

“We expect Sri Lanka risk to mitigate following April elections. Declining bond yields provide an opportunity for investors to make capital gains on long term bonds.

We anticipate that foreign and Sri Lankan investors alike will exploit this opportunity to secure attractive SL sovereign bond returns going forward’’ Fernando stated.

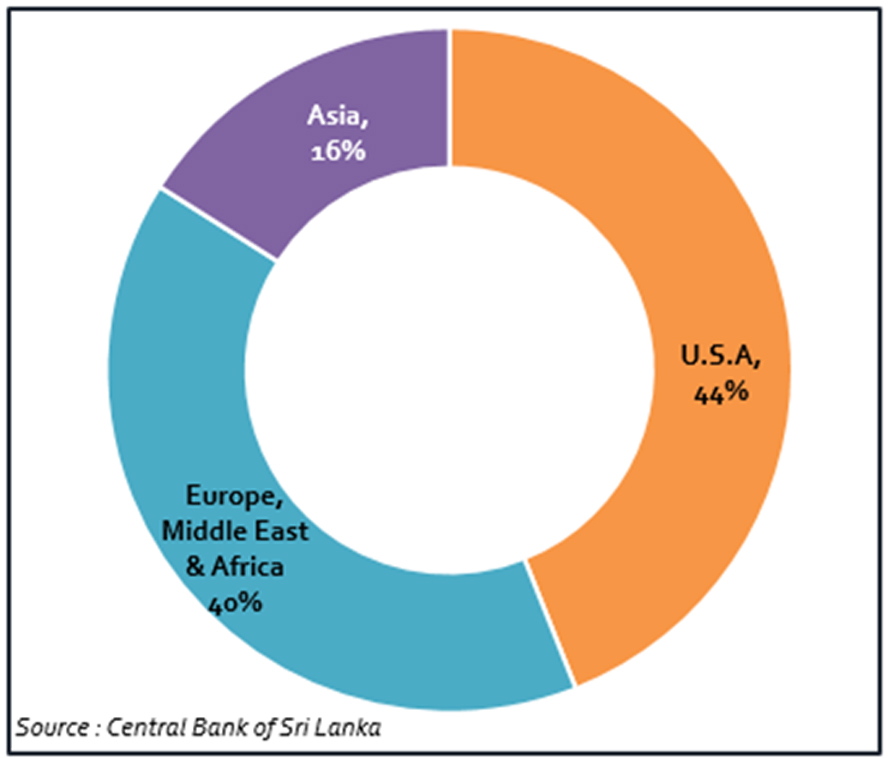

Regional Source of Investors for SL Sovereign Bonds

(10 Year ISB Issued in June 2019)

The CDBF is managed by Ceylon Asset Management (CAM) while Deutsche Bank AG serves as the Trustee and Custodian of the fund.

Local individual investors who hold a Personal Foreign Currency Account (PFCA), Corporate investors with a Business Foreign Currency Account (BFCA) are eligible to invest in the fund.

Investors can exit at any time without penalties, and repatriate in dollars.

The CDBF is the only dollar-denominated Unit Trust in Sri Lanka licensed by the Securities and Exchange Commission (SEC) and approved by the Central Bank.

The Fund Manager, CAM is an associate company of Sri Lanka Insurance Corporation Ltd and manages 7 other LKR Unit Trusts including equity funds and fixed income funds.

Past performance is not an indicator of future performance, investors are advised to read and understand the contents of the explanatory memorandum on www.ceylonam.com

Photo Caption : Dulindra Fernando, CFA, Managing Director, Ceylon Asset Management