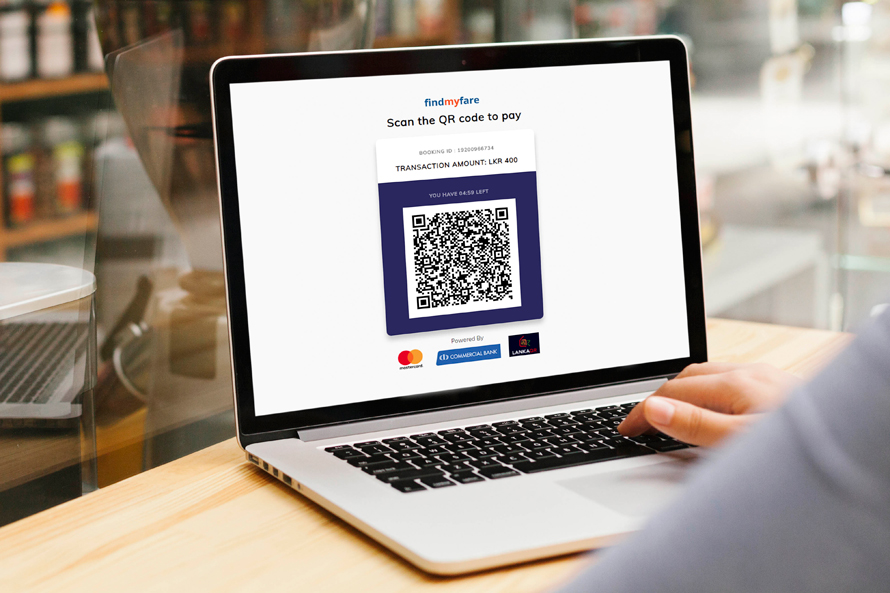

Customers purchasing flight tickets, movie tickets, hotel stays or mobile reloads on findmyfare.com can now settle their payments through the ComBank Q+ App, Sri Lanka’s first QR based payment App under LANKAQR.

This QR payment option is listed alongside other wallet payment options such as Visa and Mastercard, enabling the website to process transactions across multiple product verticals.

The ComBank Q+ App is the first QR based payment application launched under LANKAQR, the National Quick Response (QR) standard for local currency payments introduced by LankaPay under the guidance of the Central Bank of Sri Lanka (CBSL).

The ComBank Q+ App allows merchants to accept payments through any QR based application compliant under LANKAQR by enabling customers to scan the merchant's QR code with their mobile phones, and select their Credit Card, Debit Card, current account or savings account to be used to pay for the transaction.

The App has been developed based on interoperable standards where merchants and consumers of different issuers and acquirers can transact through LANKAQR.

The ComBank Q+ application provides several unique features such as an option to check/verify the transaction, support of both Static and Dynamic QR options, real-time updates via a text or in-app message, real time credits to the Merchant Account that brings convenience to both the merchants and customers, mass printed QR (in Statements/ Bills Etc.), dynamic QR on demand and system integrations.

The QR code integration with the e-Commerce site will enable customers make convenient and secure purchases via the findmyfare web site, without running the risk of accidental payments, the Bank said.

QR payments are safe as the customer initiates the payment process by scanning the QR code of the merchant and the transaction must be confirmed and authorised before the amount is debited.

Apart from the QR payments, the Internet Payment Gateway service provided by the Commercial Bank to Findmyfare to accept online card payments covers the authorisation of Credit and Debit cards, and processing of direct payments through Visa, Mastercard and UnionPay branded cards.

The online payment processing of www.findmyfare.com will be facilitated by the Bank through Mastercard Payment Gateway Services (MPGS) which is fully-compliant with Payment Card Industry Data Security Standard (PCI-DSS) requirements.

It is a secure e-commerce solution as merchants are provided with ‘server-hosted pages’ whereby card details are processed on the Payment Server and not at the merchant's end.

Since its launch in 2012, findmyfare.com has become Sri Lanka’s largest online travel company, providing the best travel deals.

The portal allows customers to search, compare and book cheap flights and hotels around the world.

The company was the very first in Sri Lanka to provide an online reservations facility that enabled customers to confirm bookings without a credit card payment.

Findmyfare.com, made a unique mark in Sri Lanka’s travel industry by giving customers a quick, easy and reliable new way of making travel reservations.

The first Sri Lankan Bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 10 years consecutively, Commercial Bank is celebrating its 100th anniversary this year.

The Bank, which won more than 50 international and local awards in 2019, operates a network of 268 branches and 873 ATMs in Sri Lanka.

Commercial Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Representative Office in Yangon and a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.