Businesscafe - People’s Leasing & Finance PLC (PLC), a pillar of strength and stability in Sri Lanka’s financial sector, successfully concluded the 1st Quarter of the fiscal year 2023/24 with a year-on-year increase in Profit of 80.9% in the midst of a challenging economic landscape.

Businesscafe - The Commercial Bank of Ceylon has once again been declared the Asian Development Bank’s (ADB’s) ‘Leading Partner Bank’ in Sri Lanka for trade and finance transactions, in a significant reaffirmation of the Bank’s contributions in that sphere to the national economy.

Businesscafe - Orient Finance PLC, a renowned financial institution dedicated to empowering individuals and supporting businesses with its comprehensive range of products, services, and expertise, is thrilled to announce the inauguration of its latest branch in Piliyandala.

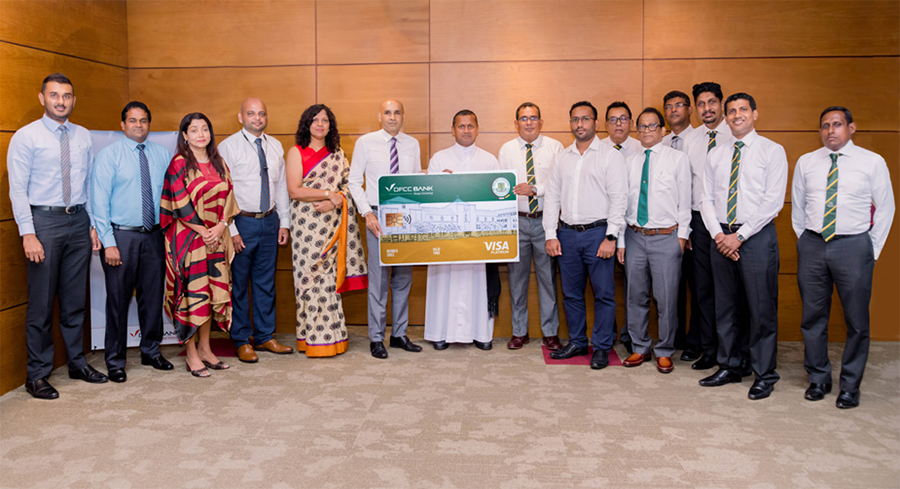

Businesscafe - In a significant stride towards enhancing financial convenience and exclusive benefits for members of the St. Sebastian's College Old Boys' Association (OBA), DFCC Bank has proudly partnered with the OBA to introduce the exclusive DFCC St. Sebastian's College OBA Affinity Credit Card.

Businesscafe - In a significant step towards bolstering food safety standards and strengthening the export sector, Sri Lanka’s leading private sector bank HNB PLC, recently hosted a certification ceremony for participants of the Preventive Controls Qualified Individual (PCQI) Training Course.

Businesscafe - The Commercial Bank of Ceylon PLC has once again announced a new leasing promotion with Browns Agriculture, to empower the country’s farming community to acquire cutting-edge technology and equipment in order to enhance productivity.

Businesscafe - Empowering SMEs at the grassroots, Sri Lanka’s leading private sector bank, HNB PLC, partnered Pay&Go to launch its groundbreaking POS System, offering businesses accessible and affordable payment solutions.

Businesscafe - Nations Trust Bank and American Express are marking their two-decade long partnership and commitment in providing service excellence to valued Cardmembers with the Nations Trust Bank American Express Credit Cards launched in 2003.

Businesscafe - In a resounding reflection of its unwavering commitment to innovation and user-centric design, DFCC Bank’s groundbreaking website has once again emerged triumphant, securing a prestigious Silver Award for Best Website in the Banking and Finance Category at the BestWeb.LK Awards 2023.

Businesscafe - Consolidating its position as the nation’s leader in Islamic Banking solutions, Sri Lanka’s most innovative private sector bank HNB PLC’s Al Najaah unit continued its winning streak at the Sri Lanka Islamic Banking and Finance Industry Awards (SLIBFI) 2023.

Businesscafe - Sampath Bank PLC, in collaboration with the Board of Investment of Sri Lanka (BOI) and the Ministry of Investment Promotion, proudly unveiled the comprehensive Banking Guide titled 'Sri Lanka Banking Guide for Investors and BOI Companies’.