Businesscafe - DFCC Bank, the premier commercial Bank in Sri Lanka, implemented a programme to recognise key cinnamon exporters and the significant contributions made by the exporters and their value chain, and to commemorate their hard work in increasing foreign exchange flows into the country.

Businesscafe - Seeking to serve a wider clientele and increase accessibility to financial services, IDEAL Finance Limited (IFL), one of Sri Lanka’s reputed finance companies, recently unveiled the latest addition to its branch network with a new branch in Kadawatha.

Businesscafe - The automated cash dispensing network of the Commercial Bank of Ceylon which comprises of ATMs and Cash Recycler Machines (CRMs) dispensed a mammoth Rs 91.872 billion in December, as Sri Lankans celebrated the festive season and prepared for 2022.

Businesscafe - Sri Lanka’s oldest finance company, Alliance Finance Company PLC (AFC), has secured a USD 5 Mn medium term financing facility from impact investing fund, EMF Microfinance Fund AGmvK, Liechtenstein advised by Swiss based Enabling Qapital S.A.

Businesscafe - Pioneering the evolution of cashless and contactless payments in the tourism sector, Sri Lanka’s leading private sector bank HNB PLC, partnered with Cinnamon Hotels & Resorts to launch the LANKAQR facility for the renowned hospitality chain’s portfolio of restaurants.

Businesscafe - DFCC Bank, one of the premier commercial Banks in Sri Lanka ushers in the New Year with the appointment of new Chief Executive Officer, Mr. Thimal Perera who took over the reins from the 01st of January 2022.

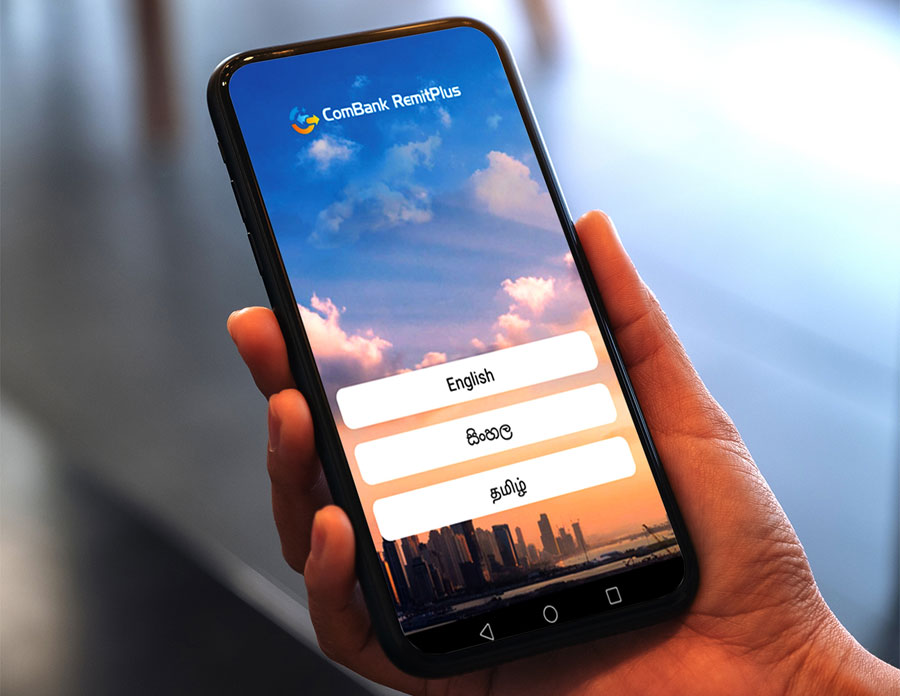

Businesscafe - The Commercial Bank of Ceylon has announced that it is starting 2022 on a rewarding note with the launch of ‘Win a Million’ – a remittance promotion that will make four instant millionaires in four months and reward another 40 recipients of remittances with a total of Rs 1 million in cash.

Businesscafe - The District General Hospital Trincomalee is the latest beneficiary of Commercial Bank of Ceylon’s initiative to support government hospitals and healthcare institutions, and has received some essential medical equipment that will enhance the emergency care provided by the hospital.

Businesscafe - To facilitate hassle free banking through formal channels, particularly for migrant labour, Sri Lanka’s leading private-sector bank HNB PLC, announced the opening of its newest mini customer centre at the Department of Immigration and Emigration in Battaramulla.

Businesscafe - The Colombo Stock Exchange (CSE) has adopted the United Nations Women’s Empowerment Principles (WEPs) as part of its commitment to promoting gender equality and women’s empowerment in the workplace, marketplace and community.

Businesscafe - DFCC Bank, one of the premier commercial Banks in Sri Lanka is proud to announce the launch of the ‘DFCC Aloka’, a financial proposition exclusive for women, with the prime goal of enabling women to achieve their aspirations through innovative financial, non-financial solutions, and value additions that provide a holistic approach in the economic empowerment and development of a woman.