Bringing together leaders from government, business and policy, the session emphasised Deloitte’s continued commitment to driving national dialogue around fiscal reform, economic resilience, and sustainable growth.

The webinar served as a platform for Deloitte thought leaders and industry experts to interpret the 2026 Budget’s implications for business and investment, and to provide practical insights that help organisations navigate Sri Lanka’s evolving economic landscape.

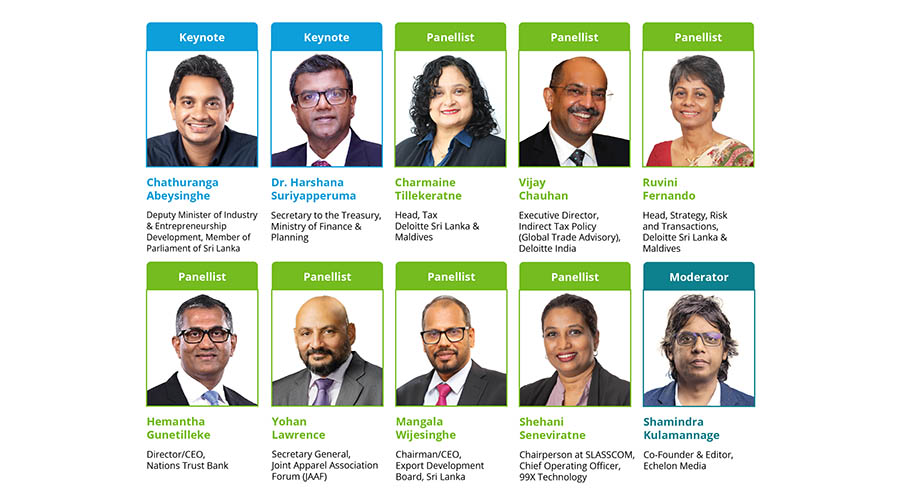

The panel featured Dr. Harshana Suriyapperuma, Secretary to the Treasury, Ministry of Finance & Planning; Chathuranga Abeysinghe, Deputy Minister of Industry & Entrepreneurship Development and Member of Parliament of Sri Lanka; Hemantha Gunetilleke, Director/CEO, Nations Trust Bank; Yohan Lawrence, Secretary General, Joint Apparel Association Forum (JAAF); Mangala Wijesinghe, Chairman/CEO, Export Development Board, Sri Lanka; Shehani Seneviratne, Chairperson at SLASSCOM and Chief Operating Officer, 99X Technology; alongside Deloitte leaders Charmaine Tillekeratne, Head – Tax, Deloitte Sri Lanka & Maldives; Ruvini Fernando, Head - Strategy, Risk and Transactions, Deloitte Sri Lanka & Maldives; Vijay Chauhan, Executive Director, Indirect Tax Policy (Global Trade Advisory), Deloitte India.

The discussion was moderated by Shamindra Kulamannage, Co-Founder & Editor, Echelon Media.

Opening the session, Charmaine Tillekeratne summarised the key fiscal and non-fiscal proposals of Budget 2026, highlighting the continuation of reforms focused on broadening the tax base and strengthening compliance frameworks.

She noted that these measures reinforce the government’s ongoing drive toward a predictable and transparent fiscal environment.

Deputy Minister Chathuranga Abeysinghe, delivering his keynote, outlined the government’s vision of moving from stability to predictability, anchored by six policy areas — sustainable growth, export diversification, debt sustainability, production-led growth, social equity, and digital transformation.

He emphasised that consistency in fiscal management will play a central role in maintaining investor confidence and achieving long-term growth.

Building on this, Dr. Harshana Suriyapperuma elaborated on the policy rationale behind ongoing fiscal reforms, including the gradual removal of para-tariffs and the implementation of a national tariff policy.

He noted that these measures are designed to enhance transparency, attract investment, and align Sri Lanka’s tax structure with global best practices.

He also emphasised the importance of digital governance, SOE reforms, and public-sector efficiency in driving future fiscal stability.

Industry leaders provided practical perspectives on how Budget 2026 could translate into on-ground progress.

Hemantha Gunetilleke reflected on the importance of balancing fiscal consolidation with access to finance, noting that a stable policy environment and a resilient banking sector are vital to sustaining credit flow and business confidence.

Shehani Seneviratne highlighted the IT sector’s growing role in export diversification and called for continued focus on talent retention and digital infrastructure to drive innovation.

Mangala Wijesinghe spoke on strengthening Sri Lanka’s export potential through investment-friendly policies, emphasising the importance of attracting both local and foreign investment to enhance competitiveness and sectoral capacity.

Yohan Lawrence discussed the impact of VAT reforms on manufacturing and the need for efficient refund processes to support cash flow in export-led industries.

Adding a broader lens, Ruvini Fernando and Vijay Chauhan shared insights on investment mobilisation and regional tax competitiveness.

Ruvini emphasised that sustainable development requires effective public–private partnerships (PPPs) and a strong capital-market ecosystem.

Vijay added that Sri Lanka’s shift toward transparent and consistent tax structures positions it favourably among regional economies looking to attract trade and investment.

The panel explored how consistent fiscal discipline, digital transformation, and collaboration between public and private sectors can accelerate Sri Lanka’s economic progress.

Participants agreed that while Budget 2026 maintains a steady policy direction, its success will depend on effective execution and continued stakeholder engagement.

Reflecting on Deloitte’s commitment to national progress, the discussion reinforced the firm’s continued role in facilitating dialogue that connects policy and enterprise.

Through its insights and collaborations, Deloitte aims to help shape an ecosystem where businesses can operate with confidence and predictability, driving sustainable growth and long-term value creation for Sri Lanka.