Prior to the addition of SLT and LECO bills the Bank’s credit card customers could automate their payments to four of the most subscribed utility service providers in the country – Dialog, Ceylon Electricity Board (CEB), Mobitel and the National Water Supply & Drainage Board (NWSDB).

The addition of SLT and LECO to the Automatic Bill Settlement facility further enhances the versatility of the service provided to customers and the convenience offered by Commercial Bank to its cardholders.

The extension of this hassle-free facility to include more service providers enables customers to conveniently manage all their utility payments through a single Commercial Bank Card at any given time and helps them to adopt digital payment habits, the Bank said.

To avail of this hassle-free bill payment facility, ComBank credit card holders simply have to enter their credit card details via the Bank’s website, accept terms and conditions and register a designated card, just once, the Bank said.

They can complete this seamless online registration process without having to visit a branch.

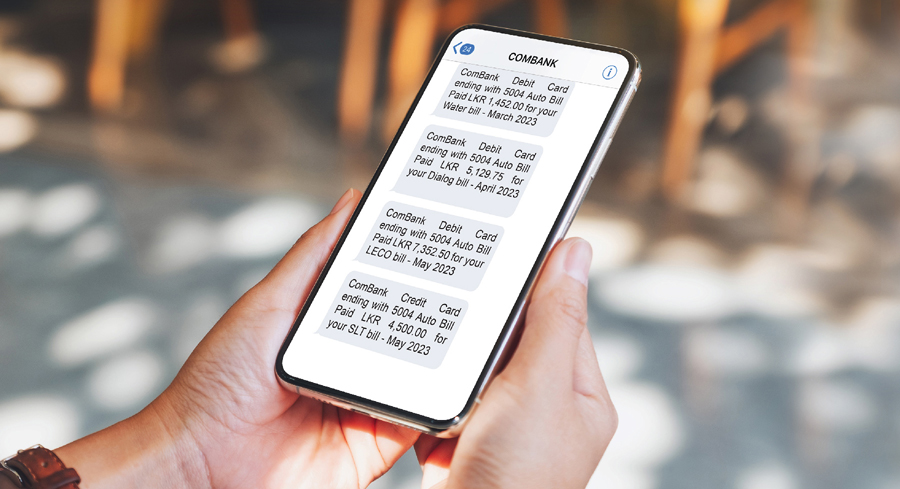

After successful registration for the service, each utility or any other entity will present the customer’s monthly bill amount to the bank and bank will authorise the payment on behalf of the credit card holder and send the receipt of payment to the customer via e-mail or SMS.

Commercial Bank Card holders can register their Visa, Mastercard, UnionPay and LankaPay/JCB Credit Cards to use the Automatic Bill Settlement facility.

The Bank has been offering this facility for the settlement of bills to other entities since 2017.

Besides ensuring that bills are settled on time without any involvement from the customer, the Automatic Bill Settlement facility prevents accumulation of arrears due to unpaid bills, saves customers from delinquency fees and prevents disconnection of utility services due to delayed payments.

Furthermore, customers can earn Max Loyalty Rewards points that can be redeemed later on at many reputed merchant outlets island-wide.

Commercial Bank cards are the market leader in Sri Lanka with a market share of over 23%.

The Bank offers a variety of credit cards in the Silver, Gold and Platinum tiers as well as in the premium segment.

The cards are equipped with ‘Tap ’n Go’ NFC technology and are backed by a strong NFC Point-of-Sale (POS) network.

ComBank Cards provide an exciting array of promotions and offers across all categories in addition to the Max Loyalty Rewards scheme for selected card categories covering both credit and debit cards.

Sri Lanka’s first 100% carbon neutral bank, the first Sri Lankan bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 12 years consecutively, Commercial Bank operates a network of 270 branches and 950 automated machines in Sri Lanka.

Commercial Bank is the largest lender to Sri Lanka’s SME sector and is a leader in digital innovation in the country’s Banking sector.

The Bank’s overseas operations encompass Bangladesh, where the Bank operates 20 outlets; Myanmar, where it has a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.