And among those numbers, there’s one that too many overlook until it’s too late: taxes.

For women entrepreneurs striving to build something meaningful and lasting, understanding taxation isn’t just a legal requirement, it’s a business advantage.

Taxes can feel like a complex and intimidating topic, especially if you’re just starting out.

But the truth is, tax knowledge is power.

It helps you price your products correctly, manage your income responsibly, and build the credibility your business needs to access funding or grow internationally.

So, what is tax? Simply put, it’s the contribution every citizen makes to build the country we want to live in.

From healthcare and free education to infrastructure and social services—91% of the government’s spending last year was covered by taxes collected from individuals and businesses like yours.

Paying taxes isn’t just a duty; it’s your stake in the nation’s progress.

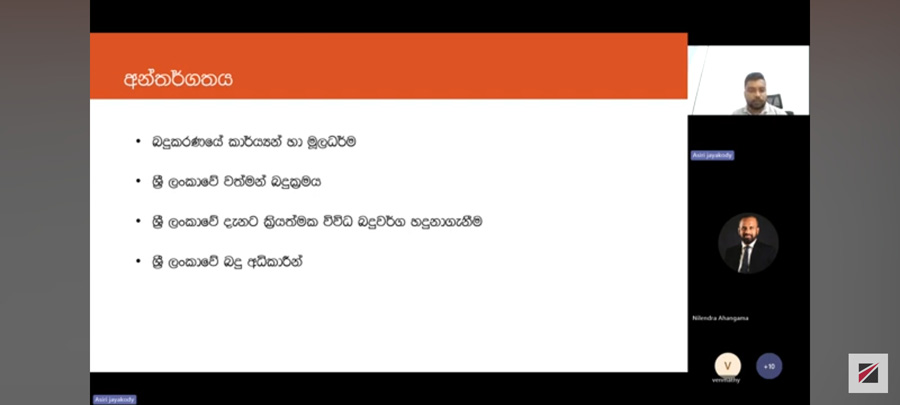

For entrepreneurs, taxes come in many forms, income tax, VAT, import duties, stamp duty, and more.

And the rules depend on the nature and size of your business.

For example, if you're a sole proprietor earning over LKR 1.8 million a year (or LKR 150,000 per month), you’re legally required to pay income tax.

If your business is registered as a private limited company, you’re liable to pay 30% tax on profit.

If you import goods to resell, you must pay VAT, SSCL, and various custom duties, depending on the product and its HS Code.

One of the most common missteps among small business owners is excluding taxes when calculating the cost of their products or services. T

his can quickly erode profits.

Tax is not an afterthought, it’s part of your pricing structure.

Before you decide on how much to charge, make sure you understand what portion of that price goes toward your tax obligations.

Also crucial is separating personal finances from your business.

Keeping clear records of income and expenses isn’t just good practice, it’s a necessity for staying compliant and avoiding penalties.

Missing deadlines, failing to file returns, or not paying taxes can lead to fines, forced compliance, and even seizure of assets under Sri Lanka’s Tax Recovery laws.

But it’s not all cautionary.

There’s a powerful upside to being tax-compliant.

Maintaining a clean tax record improves your chances of obtaining a business loan, migrating abroad, or qualifying for government support.

It builds your business’s reputation and shows potential partners, banks included, that you’re trustworthy and forward-thinking.

The most important takeaway for any woman entrepreneur?

Don’t wait for someone else to bring tax matters to your attention.

Take the lead.

Get a TIN number, understand what taxes apply to your business, and consult a tax advisor to make sure you’re covered.

It’s not just about compliance, it’s about control, confidence, and long-term success.

These practical insights were delivered by taxation expert Mr. Asisiri Pradeep, during a recent session of NDB Bank’s Women’s Entrepreneurship Upskilling Programme.

His guidance helped break down complex tax concepts into actionable advice for women ready to formalise and scale their business ventures.

As part of NDB’s long-term commitment to empowering Sri Lankan women, the upskilling programme provides accessible, real-world knowledge to help women not only launch businesses but sustain and grow them with resilience.

NDB Bank remains steadfast in its mission to support women-led businesses through both financial and non-financial support, ensuring that every woman entrepreneur has the tools to grow, adapt, and thrive.

For more information on the Women’s Entrepreneurship Upskilling Programme, visit https://www.ndbbank.com/banking-on-women/vanithabhimana] (https://www.ndbbank.com/banking-on-women/vanithabhimana) or contact Thishani at 0765699251.