The novel ‘Save the Environment’ feature promotes an understanding of the social carbon footprint of consumption by assessing each transaction a user of Flash app carries out via the app.

The upgraded Flash Advanced Budgeting feature is a personal financial management tool that enables real-time budgeting with detailed categorisation of expenses.

An extension of the budgeting feature, the carbon footprint calculator is the result of integrating the app with the UN-approved Environment Impact Index for financial transactions.

This enables the Flash Digital Bank to analyse transactional data and estimate the environmental impact of each transaction made through Card payments, QR code scanning, the app or any other form.

Flash’s software identifies the amount of carbon released to the environment as a result of the user’s consumption and calculates the environmental impact of his or her carbon footprint.

Succinctly put, the upgrades to Flash enable users to understand the hidden costs of their consumption, in addition to the financial costs, the Bank said. Understanding this data can help Flash app users to make choices to invest in the environment as a means of offsetting the impacts of their consumption.

It also offers suggestions such as plant trees, invest in solar energy, reduce consumption of fuel, and such, to compensate for the individual’s carbon footprint.

This can be managed through the app’s ‘Compensation Planning’ tool.

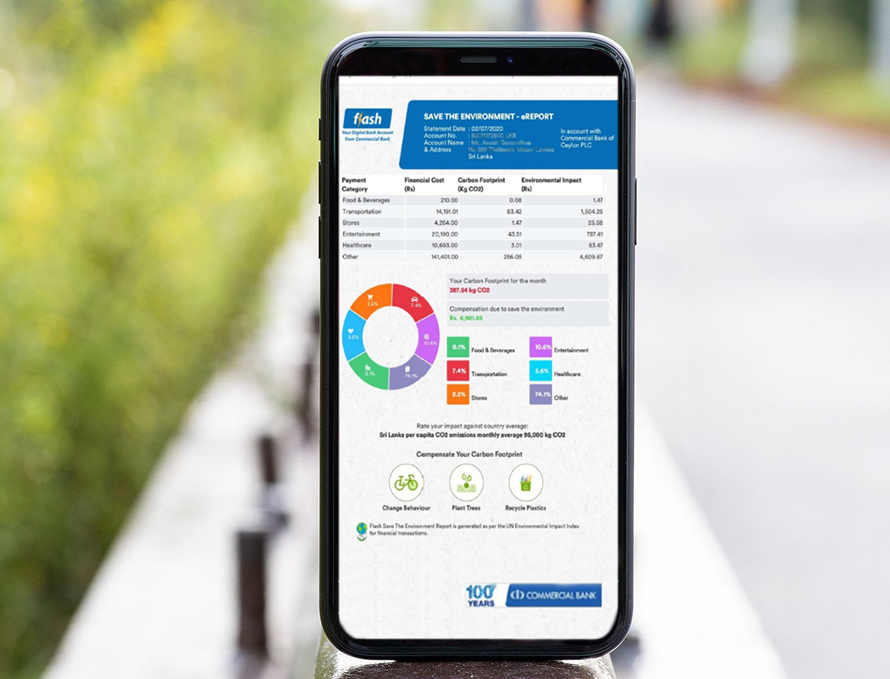

The app also enables users to download a ‘Save the Environment’ eReport that displays one’s carbon footprint in a month.

All new upgrades to the Flash app can be enjoyed free of charge by its users, the Bank said.

Commenting on the introduction of these features, Commercial Bank’s Chief Operating Officer Mr Sanath Manatunge said:

“Concern for the environment needs to become far more widespread to have a tangible impact.

Commercial Bank takes its commitment to sustainability seriously and always strives to align its products to benefit the environment.

The ‘Save the Environment’ feature, we hope, will help a predominatly young customer segment understand the invisible cost of individual transactions and become aware of how they impact the environment, creating a collective consciousness about aspects such as carbon footprint.”

The Flash app’s Budgeting feature, on the other hand, helps users to keep track of their spending and practice financial discipline, the Bank said.

Expenses can be categorised under ‘Food & Beverage,’ ‘Healthcare,’ ‘Transportation,’ ‘Entertainment,’ ‘Store’ and ‘Other’ under which individual transactions made during a particular period will be displayed with details.

The presentation of spending as a percentage under each category enables users to understand what they spend their money on most and make adjustments if needed.

Besides conveniently providing users a single dashboard to evaluate and manage personal expenses, the app also provides a downloadable history of monthly transactions in the form of an eStatement.

Notably, Commercial Bank’s Flash app is Sri Lanka’s first trilingual digital banking app and enables users to conduct transactions by following instructions in English, Sinhala, or Tamil.

The last upgrade to the Flash app was when Commercial Bank enabled Flash account users to scan a Lanka QR code of any merchant to make payments directly from the account to the merchant for goods or services.

In March this year, the Bank also made it easier for customers to open ‘Flash’ Digital Accounts by permitting 100% self-registration until further notice, removing the need to visit a branch to get started.

The first Sri Lankan Bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 10 years consecutively, Commercial Bank is celebrating its 100th anniversary this year.

The Bank, which won more than 50 international and local awards in 2019, operates a network of 268 branches and 873 ATMs in Sri Lanka.

Commercial Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Representative Office in Yangon and a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.