Sri Lanka’s merchandise exports currently is approximately USD 12 Bn annually, although the country really needs to notch exports closer to USD 20 Bn per annum to take the quantum leap into becoming a developed nation.

This will be particularly challenging given the contraction in Sri Lanka’s export markets.

While apparel showcased commendable growth in the first eight months of 2022, the industry is now seeing a considerable decline in orders due to a range of global factors, a pattern which may continue indefinitely.

Hence, looking at the paradigms unfolding globally, it is imperative that Sri Lanka remains competitive and offers potential and existing investors a competitive investor environment.

The impacts of increased taxation on apparel exports

The Joint Apparel Association Forum (JAAF) is deeply concerned by recent discussions for the removal of the concessionary rate granted to exporters, replacing this with a single rate of corporate taxation.

This would mean the rate of corporate taxation doubling for exporters.

The industry has been contributing 52 per cent to export revenue continually throughout the crisis, a contribution that is critical to keep the economy afloat, despite challenging internal and external factors.

An additional rate of taxation will make the apparel industry very uncompetitive when compared with regional peers.

Until September 2022, apparel exporters were liable to pay a concessionary corporate income tax rate of 15 per cent (which was previously 14 per cent).

However, aligned with the IMF staff-level agreement, the government tabled proposals in the 2022 interim budget to increase the standard corporate income tax rate to 30 per cent from 24 per cent, effective from the 1st of October 2022.

JAAF is disturbed by this proposed increase as the apparel industry is already confronting a 25 per cent decline in its order books for Q4 of 2022 due to the softening of global markets.

The asks of the IMF Staff Level Agreement

The IMF in its Article IV Consultation in March, identified corporate and personal income tax exemptions (CIT and PIT) to have eroded the effectiveness of the 2017 Inland Revenue Act (IRA), paving the way to large revenue losses.

This prompted the rationale to the current proposal to increase the corporate income tax rate.

As Sri Lanka only collected 7.7 per cent of its GDP in taxes in 2021, the objective of the IMF is to increase revenue collection to finance social services, critical infrastructure and public goods.

JAAF fully understands and supports the need for the proposed tax reforms as the government is challenged for options to raise much-needed revenue.

However, while the policy is well-intended, the resulting consequences are dire and may have disastrous outcomes for an industry that is striving to increase export income, local value addition, foreign direct investments, sustaining employee security and economic growth.

However, it is crucial that the government takes note of the following concerns prior to implementing the increase in corporate taxation for exporters to 30 per cent.

Comparisons to the region

Firstly, export industries do not operate in isolation and are in constant fierce competition with regional competitors.

This means that investors and buyers are actively conscious of the cost of doing business.

Therefore, businesses rationalise the pros and cons and affirm business that would favour their operations.

This may lead to shifting to countries offering lower costs of operation.

Sri Lanka is already disadvantaged in comparison to regional peers who have better trade agreements and more liberal trade policies.

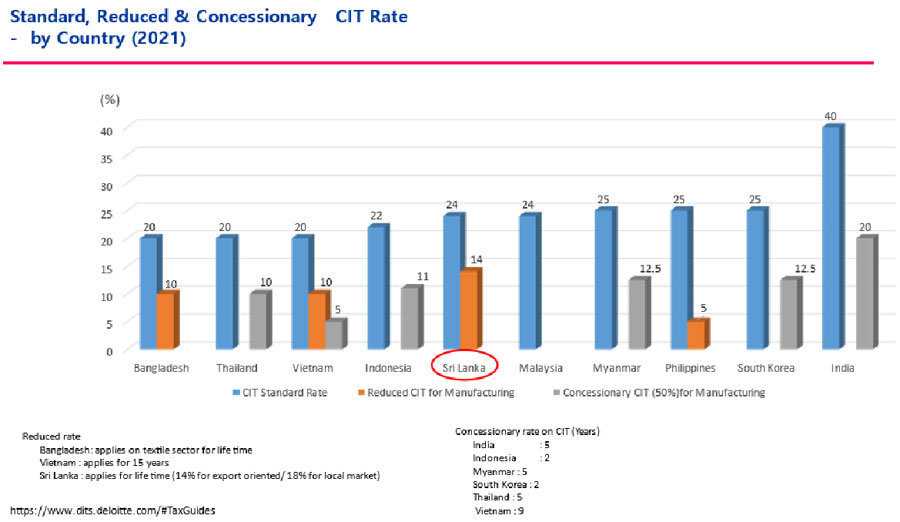

Further tightening bottom lines for exporters to pay a CIT rate higher than that of Bangladesh, Vietnam, Thailand and Indonesia for example will hurt the country’s ability to remain competitive in this region.

One key factor that must be reiterated is that Sri Lanka’s domestic milieu already discourages investors. (The graph 1.1 below depicts standard, reduced and concessionary tax rates in the region).

Further, it is worthy to note that geographically smaller countries like Hong Kong, Singapore and Dubai are modelled on low taxes at early stages of economic growth.

Even today, Singapore’s corporate income tax is imposed at a flat rate of 17 per cent with partial tax exemptions and a three-year start-up exemption extended to qualifying start-up companies.

As depicted by the graph above, it is only larger economies like India with a sizeable domestic market that are able to impose higher tax rates than regional peers.

Discouraging value addition, R&D, innovation

Increased corporate income taxes also carry the potential to discourage the value addition of existing export businesses.

For example, businesses will have reduced incentive to further reinvest their reduced profits into research and innovation and other possible avenues for product diversification and product quality improvement.

In the medium to long term, this may erode Sri Lanka’s hard-won position as a hub for sophisticated, innovative and ethics-based apparel manufacturing.

With this, Sri Lanka also runs the risk of gaining the reputation of a cost centre model that doesn’t necessarily contribute to the profit-making process of a business but still incurs costs for low-value product creation.

Rising tax rates lead to increased tax evasion

A growing body of literature has established that higher taxes and higher compliance costs consistently drives more of the economy underground and beyond the reach of the tax collector.

The National Bureau for Economic Research confirms this by reporting that as tax rates rise above the median level of 34 per cent, the extent of evasion rises dramatically.

This research also found that on average, a 1 per cent increase in the tax rate results in a 3 per cent increase in tax evasion.

Tax non-compliance and tax evasion historically have been major sources of revenue loss to the Sri Lankan government.

The Parliamentary Committee on Public Accounts (COPA) disclosed that the Inland Revenue Department has been deprived of approximately LKR 144 Bn just last year alone due to tax evasion.

In this context, JAAF has severe concerns about the doubling of corporate tax rates at a time of extreme economic distress, which may prompt businesses to evade tax compliance which will deem the very intentions of this policy of increasing government revenue, counterproductive and redundant.

Rethink the policy of doubling corporate taxation

The apparel industry is already heading into uncertainty in the next few months due to rising inflation in the biggest export markets, disruptions in global supply chains and geopolitical tensions.

Although the industry is confident that this is a temporary predicament and the industry has the capacity to emerge resilient, the timing is not necessarily be prudent and will create a further tough environment for exporters in terms of policy.

The apparel industry is determined to direct Sri Lanka into prosperity through the creation of a competitive export-oriented market economy.

Therefore, JAAF urges the government to rethink the policy of increasing the corporate income tax rate by 100 per cent (which is from the concessionary 15 per cent to 30 per cent) allowing the apparel industry and all exporters to remain competitive and engage in business and investment in the region.

In conclusion, Secretary General of JAAF Yohan Lawrence says,

“The apparel industry, which is the largest merchandise exporter reaffirms its commitment to continually support the government in its efforts to reduce the fiscal deficit.

JAAF fully supports mechanisms and processes to improve the tax administration and collection and broadening of the tax base which will lead to Sri Lanka to redirect the path of recovery and growth.”